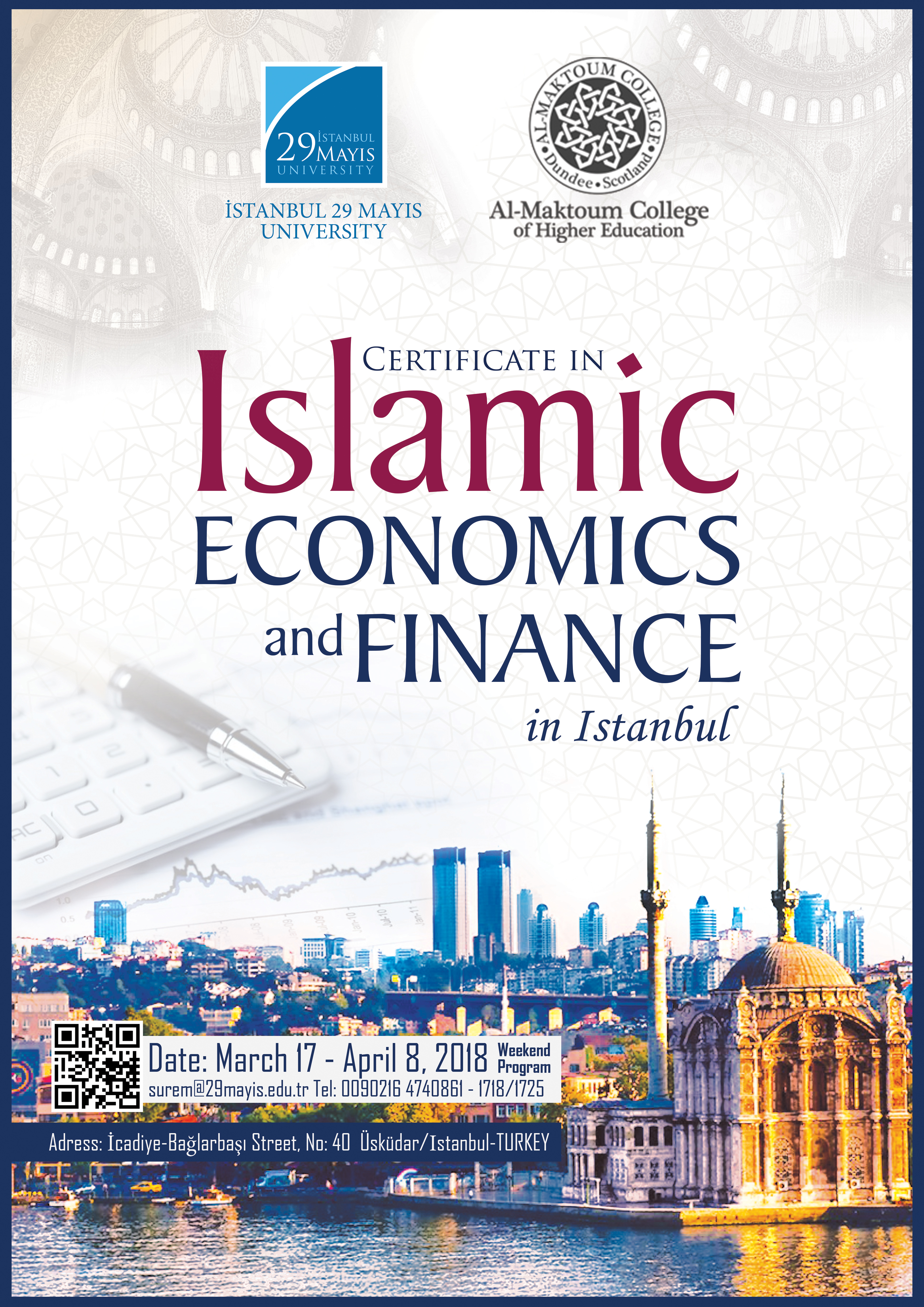

Certificate in Islamic Economics and Finance Program will start with the cooperation of İstanbul 29 Mayıs University and Al-Maktoum College for Higher Education.

Program

Unit 1: Islamic Economics and Finance (24 Hours)

Unit Coordinator: Dr. Harun Sencal

UNIT SUMMARY

The unit will cover the origin, concepts, and aims of Islamic economics, including Islamic finance as practical tool of system of Islamic economics. This unit will also develop an understanding of the history and evolution of Islamic political economy and Islamic moral economy both from Islamic and neoclassical point of views. The unit will also address systematic understanding of Islamic political economy and the axioms of Islamic moral economy which defines the frame, methodology and institutions.

It will also cover all aspects associated with Islamic Finance, including the definitions, classifications, nature, and condition of validity of transactions in Islam. Moreover, this unit will discuss the emergent financial institutions and instruments of Islamic finance. It will explore how Islamic Finance principles have evolved into structures of products and services. Issues of financial and non-financial products and services also will be considered.

This unit is linked to the Applied Islamic Banking and Insurance unit, so that students conversant with all the principles and structures behind Islamic Banking and Insurance can be empowered to engage in its application.

On successful completion of the course, students should be able to:

| SESSION | DATE | TOPIC |

| Part I: Islamic Economics | ||

| 1 | 17/3/20189:30-12:30 | Background of Islamic Economics and Various Approaches towards Islamic Economics |

| 2 | 17/3/201813:30-16:30 | An Introduction to Islamic Political Economy and Islamic Moral Economy |

| 3 | 18/3/20189:30-12:30 | Methodology of Islamic Economics |

| 4 | 18/3/201813:30-16:30 | Islam and Economic Development and Social Welfare Institutions |

| Part II: Islamic Finance | ||

| 5 | 24/3/20189:30-12:30 | Background of Islamic Finance and Current Trends |

| 6 | 24/3/201813:30-16:30 | Islamic Indices, Crowdfunding and FinTech |

| 7 | 25/3/20189:30-12:30 | Corporate and Shari’ah Governance |

| 8 | 25/3/201813:30-16:30 | Halal Markets |

The growing importance of the Islamic finance industry and the rapid global development of Islamic financial institutions, make it essential that anyone interested in the area of Islamic finance is conversant with the fundamentals, core concepts, and practical operation, control system and regulatory framework of Islamic banking and insurance. The unit will cover the differences between Islamic and western banking and insurance models in terms of conceptual framework, governing principles, governance system, business model, and product level differentiation. It will also cover all aspects associated with Islamic banking and insurance operation, including the embedding of Shari’ah compliance and regulatory frameworks in product development, asset liability management, internal control system, internal and Shari’ah audit as an independent assurance process. The unit will explore how Islamic principles have evolved into structures of products, services, control and governance system in Islamic banking and Takaful industry. The issues of Islamic banking and insurance products and services also will be critically analysed.

On completion of this unit the students should be able to:

| SESSION | DATE | TOPIC |

| 1 | 31/3/2018 9:30-12:30 |

The introduction to the course subject.Background of Islamic Finance. Institutional framework, governing principles, and governance system of Islamic and western banking and insurance. |

| 2 | 31/03/2018 13:30-16:30 |

The business model and products of Islamic banking. |

| 3 | 01/04/2018 9:30-12:30 |

The business model of Islamic insurance (Takaful) and reinsurance (Retakaful). |

| 4 | 01/04/2018 13:30-16:30 |

Sukuk |

| 5 | 07/04/2018 9:30-12:30 |

Product development in Islamic banking and insurance. |

| 6 | 07/04/20181 3:30-16:30 |

Risk and Asset liability management in Islamic banking and insurance. |

| 7 | 08/04/2018 9:30-12:30 |

Corporate governance issue within product structures, services in Islamic banking and Takaful industry, and Shari’ah governance and Internal Shari’ah control system in Islamic banking and insurance |

| 8 | 08/04/2018 13:30-16:30 |

The effect of conflict of interest between UPSIA holders and shareholders (case study) |

Contact

e-mail: surem@29mayis.edu.tr Tel: 009 0216 474 08 61 (1718/1725)